Support

Help Center

Welcome to the Help Center! This site will get you up and running with Info in under 5 minutes.

Installation

Gettting the Most Out of the App

Getting Started

Customer Sync Settings Explained

Why Customer Sync Matters

Customer synchronization ensures that your customer data remains consistent across both Shopify and e-conomic. This alignment is crucial for:

Accurate invoice generation

Consistent customer communication

Proper financial tracking

Streamlined customer service

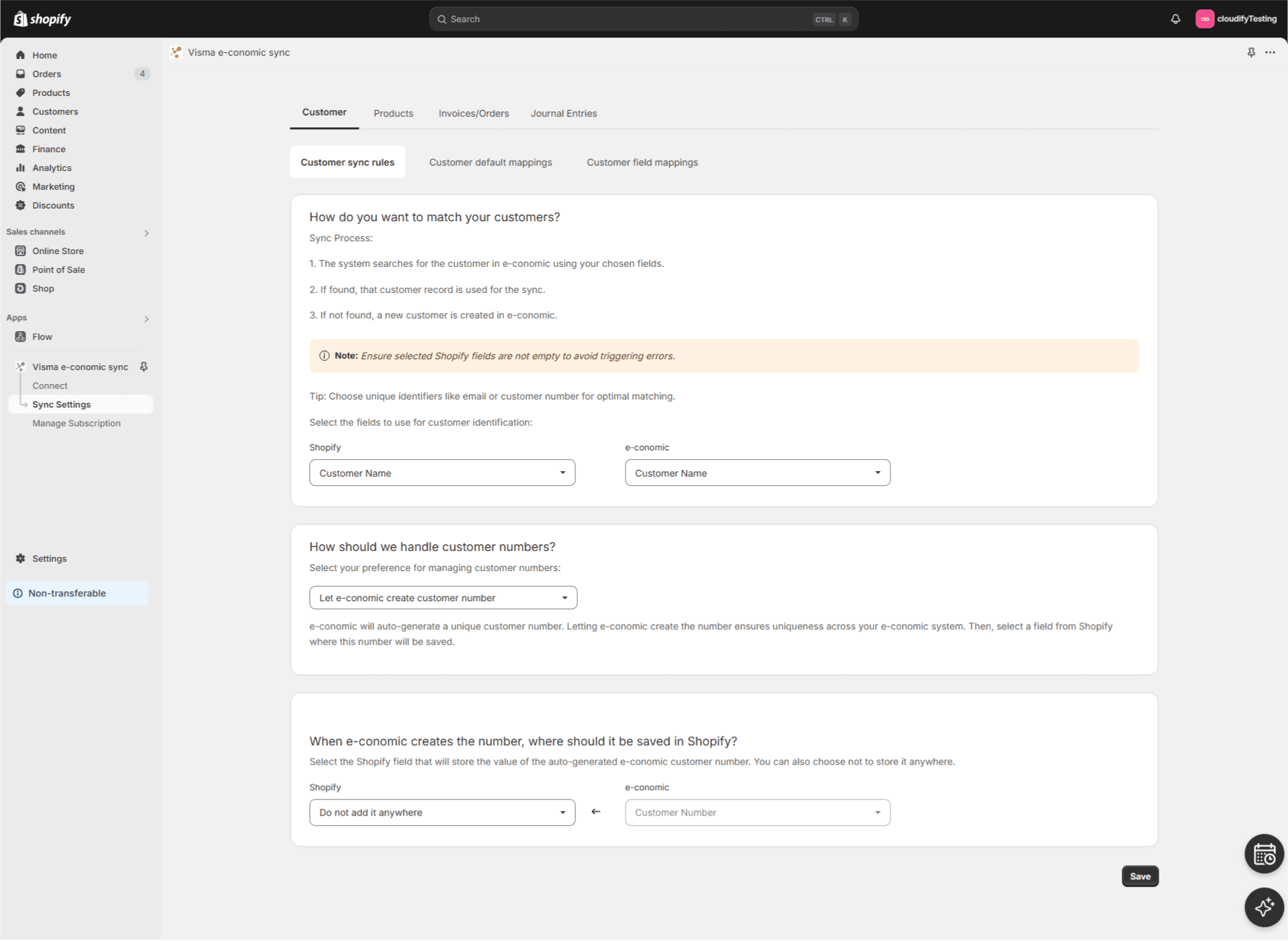

1. Customer Matching Configuration Explained

What It Does

This setting determines how the integration identifies the same customer across both systems. Think of it as teaching the system how to recognize "John Smith" in Shopify is the same person as "John Smith" in e-conomic.

Why It's Important

Prevents duplicate customer records

Ensures accurate financial history

Maintains clean customer database

Enables proper invoice tracking

Choosing the Right Identifier

Each identifier option has specific use cases:

Email Address (Recommended)

Pros: Usually unique, rarely changes

Best for: B2C businesses, online stores

When to use: Most general cases

Customer Number

Pros: Completely unique, systematic

Best for: B2B businesses

When to use: When you have an existing customer numbering system

Phone Number

Pros: Generally unique

Best for: Local businesses

When to use: When phone is your primary contact method

Customer Name

Pros: Easy to recognize

Cons: May not be unique

When to use: Only for small businesses with few customers

2. Customer Number Management Explained

Let e-conomic Create Numbers (Recommended)

Benefits:

Ensures unique numbering

Follows e-conomic's numbering system

Prevents conflicts

Maintains accounting consistency

Use Shopify Numbers

Benefits:

Maintains existing customer references

Useful when Shopify is your primary system

Better for businesses transitioning from Shopify-only operations

3. Default Customer Settings Explained

Why Defaults Matter

Default settings serve as your template for new customer creation, ensuring:

Consistency in customer records

Proper accounting categorization

Correct tax handling

Appropriate payment terms

Key Settings Explained

Payment Terms

Defines when and how customers should pay

Affects cash flow management

Sets customer expectations

Customer Group

Enables segmentation for reporting

Affects pricing rules

Influences accounting categorization

VAT Zone

Ensures proper tax calculation

Critical for international sales

Maintains tax compliance